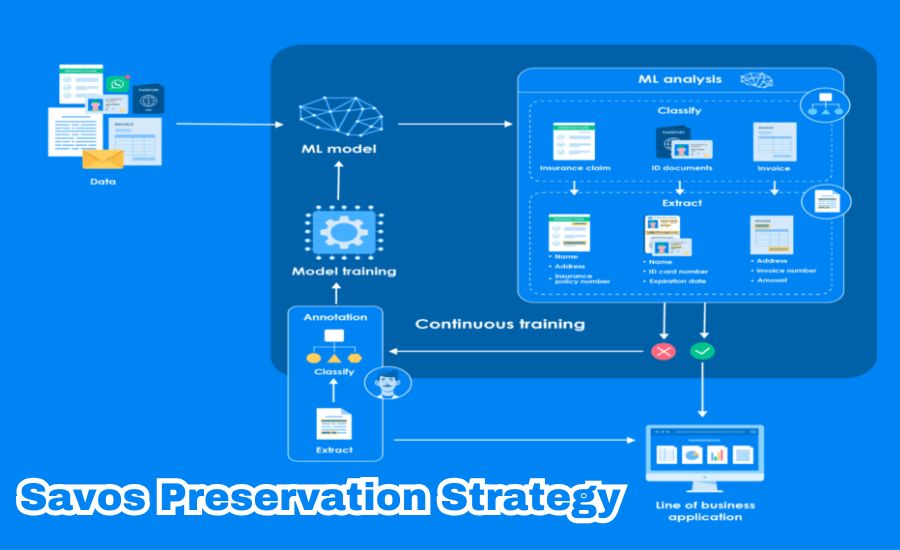

Savos Preservation Strategy helps protect finances and ensure a stable future. Many people want to ensure their money is safe and growing, and that’s where the Savos Preservation Strategy can help. This strategy focuses on keeping your savings secure while assisting them to grow over time so you can feel more confident about tomorrow.

With this strategy, you don’t need to worry about significant risks. Instead, it’s all about taking careful steps to build and protect your wealth. Let’s dive into Savos Preservation Strategy, how it works, and why it might be a good choice for people who want a safe and steady way to manage their money.

What is Savos Preservation Strategy? A Simple Explanation

The Savos Preservation Strategy is designed to keep savings safe while also helping them grow. Unlike risky investments, this strategy focuses on steady, secure financial planning. Many people choose this approach to protect their wealth over time.

In simple terms, the strategy is about making intelligent choices with your money. It’s about balancing safety and growth, so you don’t have to worry about losing too much if markets change. This approach is ideal for people who want to build a solid financial foundation without unnecessary risks.

The Savos Preservation Strategy is often used by those nearing retirement or who prefer a stable investment. Focusing on preservation helps people avoid major financial setbacks. Overall, it’s a way to grow savings safely and control.

How Savos Preservation Strategy Works to Protect Your Money

This strategy works by carefully choosing low-risk investments that offer steady returns. Unlike high-risk stocks, the Savos Preservation Strategy aims to protect your capital first. It’s not about making fast profits but rather about long-term growth.

Using this strategy, your money is placed in reliable options, such as bonds or stable funds. These options give little returns quickly, but they keep your savings safe. It’s a gradual approach that adds security to your financial plan.

The Savos Preservation Strategy helps you avoid significant losses by focusing on safety. Many find this helpful for financial goals like retirement savings or significant life expenses.

Top Benefits of Using Savos Preservation Strategy

The Savos Preservation Strategy has many benefits that can help you feel secure about your financial future. Here are the top advantages of using this strategy:

- Peace of Mind: One of the main benefits of the Savos Preservation Strategy is the peace of mind it brings. Because this strategy focuses on low-risk investments, you don’t have to worry about significant losses. This gives you the confidence that your money is safe and growing steadily over time.

- Steady Growth: While the strategy isn’t designed to make you rich quickly, it does offer reliable growth. The returns may be smaller than high-risk options, but they are consistent. This steady growth can benefit long-term goals, like retirement savings or future expenses.

- Flexibility for Financial Goals: The Savos Preservation Strategy is flexible and can work for different financial goals. Whether you’re saving for retirement or a significant purchase or want a stable fund for emergencies, this strategy can adapt to your needs. It’s designed to provide a balance between security and growth.

- Protection Against Market Fluctuations: Unlike high-risk investments, this strategy protects your savings from sudden market drops. Your money is shielded from big ups and downs since it focuses on safer options, like bonds or low-volatility funds. This is especially valuable during uncertain economic times.

- Ideal for Retirement Planning: The Savos Preservation Strategy is a solid choice for people planning for retirement. It prioritizes security, which is crucial as you approach approach retirement age. With this strategy, you can feel assured that your savings will be there when needed.

By choosing the Savos Preservation Strategy, you prioritize safety, consistency, and long-term growth. This makes it an excellent choice for anyone looking to build wealth while minimizing risks.

Read More: Error-reference-store-9035551-b9ee396181ebad58

Why Choose Savos Preservation Strategy for Financial Security?

Choosing the Savoy Preservation Strategy can give you solid financial security. For many, knowing their money is protected is essential, especially during uncertain times. This strategy offers that stability.

The strategy also appeals to those who prefer a low-stress investment plan. You won’t need to watch the market daily or worry about huge swings. Instead, you can feel safe knowing your savings are in a secure plan.

The Savos Preservation Strategy is also ideal for anyone with a long-term view. If you want your money to grow slowly and securely, this strategy can be a wise choice. It’s a practical way to reach financial goals without taking too much risk.

How to Start with Savos Preservation Strategy

Starting with the Savos Preservation Strategy is simple. First, talk to a financial advisor who understands this approach. They can help you choose low-risk investments that match your goals.

Next, consider setting up an account dedicated to this strategy. You can move funds into stable options, like bonds or specific funds, and your savings can begin to grow safely.

It’s also a good idea to track your progress over time. Although growth may be slow, watching your savings build can be rewarding. Just remember, the Savos Preservation Strategy is all about steady gains.

Is Savos Preservation Strategy Right for You? Find Out Here

The Savos Preservation Strategy suits those who want to protect their money and avoid significant risks. If you value security over quick profits, this approach may be a great fit.

This strategy also suits people who have specific financial goals. For example, if you’re saving for retirement or a significant expense, the Savos Preservation Strategy can provide stability. It’s an intelligent option for long-term savers.

On the other hand, this strategy may only be ideal for some. You should explore different options if you’re looking for fast returns. However, this strategy is highly effective for those seeking safety and growth.

Savos Preservation Strategy vs. Traditional Savings: What’s Different?

The main difference between the Savos Preservation Strategy and traditional savings is the focus on growth. While a savings account offers essential interest, this strategy aims for better returns through careful investments.

With traditional savings, your money stays safe but grows slowly. The Savos Preservation Strategy, however, helps your money grow faster by using low-risk investments. This balance of safety and growth is what makes it unique.

Additionally, the strategy involves a plan. Unlike a simple savings account, this approach requires careful planning to ensure steady gains. By following the Savos Preservation Strategy, you can make more out of your savings.

5 Smart Reasons to Use Savos Preservation Strategy Today

Choosing the right financial strategy can be tricky, but the Savos Preservation Strategy stands out for its reliability and security. Here are five smart reasons to consider this strategy today:

- Low-Risk, High Security: The Savos Preservation Strategy prioritizes protecting your savings. It’s designed to grow your money with minimal risk, making it a great choice if you want to avoid significant losses. This security is perfect for people who value stability over high-risk gains.

- Consistent, Steady Returns: This strategy focuses on steady, reliable growth instead of quick profits. With consistent returns, you can watch your savings grow over time. It’s ideal for planning long-term goals, allowing your money to grow steadily without significant risks.

- Suits Different Financial Goals: Whether you’re saving for retirement, an emergency fund, or a big purchase, the Savos Preservation Strategy adapts to fit your financial goals. This flexibility lets you adjust your approach as your life changes, making it a wise long-term choice.

- Protection from Market Volatility: Markets can be unpredictable, but the Savos Preservation Strategy shields your money from large ups and downs. Focusing on low-risk investments helps your money stay safe even when the market fluctuates, offering added security in uncertain times.

- Perfect for Retirement Planning: If retirement is on your mind, this strategy is an excellent option. It provides a steady path for saving over time and reduces the worry of losses when you need stability most. This approach helps you build a secure retirement fund with confidence.

In short, the Savos Preservation Strategy is a safe and smart option for anyone wanting steady growth with low risk. It’s a practical way to achieve financial security today, tomorrow, and in the future.

Easy Steps to Understand Savos Preservation Strategy

Understanding the Savos Preservation Strategy is easy. First, learn about low-risk investments. These are safer choices that can help your money grow slowly.

Next, focus on long-term planning. The strategy is about building wealth steadily, so patience is vital. You’re not looking for quick gains but relatively secure growth over time.

Finally, remember the importance of security. The Savos Preservation Strategy is designed to keep your money safe, making it ideal for anyone looking to protect their wealth.

Who Can Benefit Most from Savos Preservation Strategy?

People nearing retirement are great candidates for the Savos Preservation Strategy. They want to protect their savings without risking too much, and this strategy offers that security.

Young savers can also benefit. By starting early, they can build a safe financial foundation. This approach grows savings gradually, which is perfect for those with a long-term outlook.

This strategy will help people with specific financial goals, like buying a house. It’s a way to save for significant expenses without taking unnecessary risks.

How Savos Preservation Strategy Helps Plan for the Future

Planning for the future is easier with the Savos Preservation Strategy. It’s designed to provide steady growth, which can help meet future financial goals. Whether for retirement or major purchases, this strategy keeps your money safe.

By avoiding high risks, the strategy reduces stress. You won’t need to worry about sudden changes in the market. Instead, your savings will grow at a steady pace, which makes future planning simpler.

This strategy is beneficial in uncertain times. With Savos Preservation, you can feel confident knowing your finances are secure, no matter what the future holds.

Conclusion

The Savos Preservation Strategy is an intelligent way to keep your money safe while helping it grow. It offers peace of mind for people who want a low-risk plan. It’s perfect for those who prefer steady, long-term growth over risky, quick gains. Focusing on safety helps you reach financial goals without worry.

Using the Savos Preservation Strategy, you don’t need to stress about significant losses. Instead, you can feel confident that your savings are building slowly and securely. Whether you’re saving for retirement, a big purchase, or just a safe future, this strategy is a helpful choice for financial stability.

You Must Read: Who-owns-angelos-pizza-and-restaurant-harvard-illinois-2024

FAQs

Q: What is the Savos Preservation Strategy?

A: It’s a safe way to grow your money slowly while protecting it from significant risks.

Q: Who should use the Savos Preservation Strategy?

A: This strategy is excellent for protecting one’s savings, especially those planning for retirement.

Q: Is the Savos Preservation Strategy low-risk?

A: It focuses on low-risk investments, making it a safer option for steady growth.

Q: Can beginners use the Savos Preservation Strategy?

A: Yes, beginners can benefit because it’s easy to follow and doesn’t need risky decisions.

Q: Do I need a financial advisor for this strategy?

A: An advisor isn’t necessary, but they can help you make the best choices if you’re new to investing.

Q: How does it differ from regular savings accounts?

A: It aims for better growth than savings accounts by using safer investments for steady returns.

Q: Can I change my investments later?

A: You can adjust your investments over time to match your changing financial goals.